|

|

eastman47 LV16

发表于 9-10-2012 18:54:49

来自手机

|

显示全部楼层

本帖最后由 eastman47 于 9-10-2012 22:07 编辑

ZT:

看看别人的说法:

Courts Asia Limited ("Courts" or the "Company") registered its prospectus today.

The link is here.

This was a continuation of my earlier preview post.

Company Description

The Company is a leading electrical products, IT products and Furniture retailers in Singapore and Malaysia and is offering 178m shares (60m New Shares and 118m Vendor shares) at $0.77 each for its Initial Public Offer. The Company has a strong brand equity, with more than 25 years presence in both Singapore and Malaysia. The IPO will close on 11 Oct 12 at 12pm and starts trading on 15 Oct 12.

Vendor sale

The vendors selling the shares are primarily the PE Investors and the subscribers are:

77.92m - Cornerstone Investors (about 43.8% of the offering)

14.285m - Key Mgmt CEO and CFO (about 8% of the offering)

85.795m - the balance shares via placement and public tranche where 76.895m shares will be offered via placement and 8.9m shares via public offer.

Courts has met the new IPO guideline for the retail tranche which SGX intends to adopt even though it is not effective yet. Kudos to Courts for the early adoption. I guess the next 'best thing' it can do is to allocate more to the retail tranche should the demand be overwhelming.

There is an over-allotment issue of 17.159m shares should the demand be overwhelming. If this is triggered,

it will definitely bode well for the Company

as the stabilizing manager will step in should the price drops below its IPO

price of $0.77.

Good market dominance

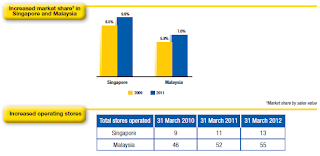

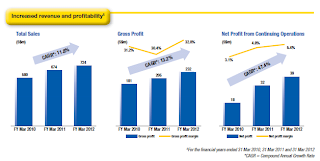

As of 2011, Courts has a market share of 9.8% in Singapore and 7.0% share in Malaysia and the number of retail outlets have gradually increased over the last 3 years.

Improving Financial Performance

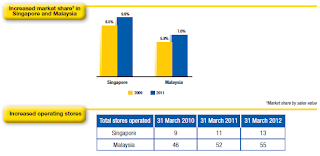

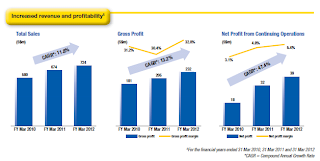

In terms of financial performance, the Company has also done well over the last 3 years with Sales growing from $580m to $724m in FY2012 and Net Profit from $18m to $39m in the same period.

Courts Price Promise

Haven't heard of the Courts' Price Promise? Here you go.

Stable Management

The CEO, COO and CFO have been with the Company for more than 15 years each. Which is probably rare in today's context. What is even better is that the CEO and CFO will collectively subscribed to about 14.285m shares at the IPO price of S$0.77. This is probably the best 'vote of confidence' for the company which investors are seeking given the PE backers are selling out.

Cornerstone investors

The cornerstone investors are:

JF Asset Management

New Silk Road Investment

Target Asset Management

Value Partners

The cornerstone investors are reputable "value investors" and not your typical hedge funds. While they are not subject to moratorium, they are definitely not the flippers and are probably attracted by the value proposition of Courts Asia. I definitely view the list of Cornerstone investors which they have lined up as A+ kind of investors.

Use of Proceeds

The Company intends to use the proceeds raised from the 60m New Shares to expand into Indonesia and for working capital purpose. I thought that is the most logical sense due to the rising middle class and wealth in Indonesia. The growth story in Indonesia is a compelling one and the ability to offer in-house credit will probably help improve the margins further.

Dividends

The Company intends to pay 30% of the Group's current year profit for the half year till 31 March 2013 and full year till 31 March 2014. Assuming the net profit remained the same at $39.4m for FY 2013 and FY2014 for simplicity sake, $11.82m will be paid out. The EPS will be 7.03 Singapore Cents and the Dividend Per Share will be 30% x 7.03 = Singapore 2.11 cents. Based on the IPO price of 77 cents, the yield works out to be 2.74%. There will be upside to the yield if you believe in the continued growth story and profitability trend of Courts Asia. My only wish was that they should have included the latest financial performance in the prospectus as well as those information they shared with Cornerstone Investors.

Key Competitors

The key competitors in Singapore are Best Denki, Pertama, Challenger and Ikano. In Malaysia, they are Senheng, Elitetrax, Ikano and Best Denki.

Valuation

The Company is listed at a historical PER of 10.95x. The closest listed peer is probably Challenger Technologies. Challenger is trading at a historical PER of 8.7x. Pertama Holdings which run the Harvey Norman speciality retail shop is previously listed but has since been suspended as the owner tries to take the company private. In terms of historical PER, the Company may be fairly valued. However, the market is forward looking and the future definitely 'looked brighter'. Assuming EPS grows by 25% in FY13. (I am just guessing). The implied EPS will be 8.85 Singapore cents and the forward PE will drop to 8.7x. The implied yield will be around 3.4%.

Assuming a fair value range of 9-11x, the probable trading range will be between 80c to 97c (I am guessing).

Conclusion

Courts Asia is probably worth a second look for both short and medium term. For short term punters, it probably deserve at least a 2 Chilli Rating. The over-allotment and dividend will provide some downside protection and the presence of value cornerstone investors and management buying in at the IPO price will definitely bode well for longer term investors. I may consider adding some of the shares for my SRS portfolio if the price is right.

|

|

IP卡

IP卡 狗仔卡

狗仔卡 显身卡

显身卡